Usually by the time clients contact us, they know bankruptcy is the best option for relief from their overwhelming debts. But they may not know that there are different types of bankruptcy, each with their benefits, depending on your situation. We’re here to assess your finances and educate you about your options.

Chapter 7

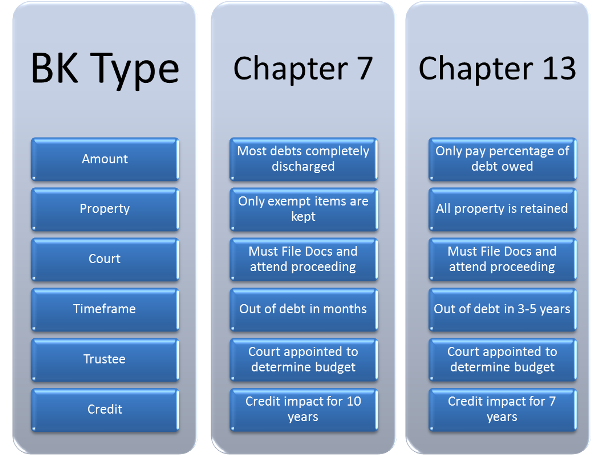

When most people think of a bankruptcy, they are thinking of a Chapter 7. With this type of bankruptcy, much of your debt can be discharged. Unsecured debt, such as credit cards, medical bills, unpaid rent and utilities, and personal loans can be discharged, or forgiven, in a Chapter 7. Secured debts are debts requiring collateral, such as mortgages and auto loans. Secured debt may be included in a bankruptcy, but if you’d like to keep your home or auto, you may be able to do so as long as you are current on your payments. Priority debt, including child support, alimony, tax debt, and student loans cannot be discharged in a Chapter 7. There are a few exceptions to these rules, and we will walk through them together as we determine how to best handle your debt.

In order to qualify for a Chapter 7 bankruptcy, you must pass the Means Test. This calculation uses your income and debt amounts to figure out if you have the “means” to pay back your debt. If you pass this test, you qualify for a Chapter 7.

Chapter 13

Chapter 13 is another type of bankruptcy that is available as a method of debt relief. This is designed for those who are in debt that they cannot keep up with, but could benefit from a repayment plan of reduced monthly amounts. Unlike a Chapter 7, debt is not completely discharged. This type of bankruptcy may be the best fit for you if your disposable income is high, you have failed the “means test”, or you have filed a Chapter 7 within the last 8 years. You will be put on a payment plan of 3 to 5 years, which will allow you to keep your assets while getting caught up on payments. This is a good option if you are behind on your mortgage or car payment, but can see yourself getting back on track within the next few years. Filing a Chapter 13 will allow you to defer student loan payments for 5 years and to also spread out your back tax payments over 5 years. If you are “upside down” on your mortgage or car loan, a Chapter 13 might be the right choice for you.

Let Us Help

Whether you choose a Chapter 7 or Chapter 13 bankruptcy, we are here to help as you strive toward financial freedom. We’re experienced and have up-to-date knowledge about all the aspects of bankruptcy law. Don’t feel like you have to navigate the system alone. We’re here to take your call! Contact us today to get started. Click here if you need a Eugene bankruptcy attorney , or check here for our other Oregon and Washington locations.

Pingback: Salem Bankruptcy Lawyers - Cascade Bankruptcy

Pingback: The Key People in Bankruptcy - Bankruptcy Attorneys

Pingback: How Bankruptcy Affects People in Your Life - Bankruptcy Attorneys

Pingback: Vancouver Bankruptcy Attorney - Cascade Bankruptcy